To reference our early automotive analogy, while every car might run a little differently, they all perform best with proactive care and maintenance. In the same way, a good month end close requires teams to iron out processes, implement checklists, and leverage automation in order to get top-notch closing times. The most efficient accounting teams don’t try to cram every close task into the close period. Instead, for things like payroll that can be accounted for in advance, they accomplish these tasks pre-close. Achieving the right level of detail and accuracy helps to identify issues, fix processes, and ultimately cut down on the time to close. However, teams must balance a desire for accuracy with a focus on prioritizing the data that’s required to inform business decisions.

How, when and why do you prepare closing entries?

Temporary accounts, also known as nominal accounts, are accounts that track financial transactions and activities over a specific accounting period. These accounts are “temporary” because they start each accounting period with a zero balance and are used to accumulate data for that period only. At the end of the accounting period, the balances in these accounts are transferred to permanent accounts, resetting the temporary accounts to zero for the next period.

Which accounts remain unaffected by closing entries?

When moving towards a more sophisticated close process, often teams start reconciling the accounts that are most important for their businesses and then expand over time. After these entries, all temporary accounts (revenue, expenses, dividends) will have zero balances, and the net income and dividends will be reflected in the Retained Earnings account. After crediting your income summary account $5,000 and debiting it $2,500, you are left with $2,500 ($5,000 – $2,500).

How do closing entries affect the Retained Earnings account?

Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary. Understanding the accounting cycle and preparing trial balancesis a practice valued internationally. The Philippines Center forEntrepreneurship and the government of the Philippines hold regularseminars going over this cycle with small business owners. They arealso transparent with their internal trial balances in several keygovernment offices.

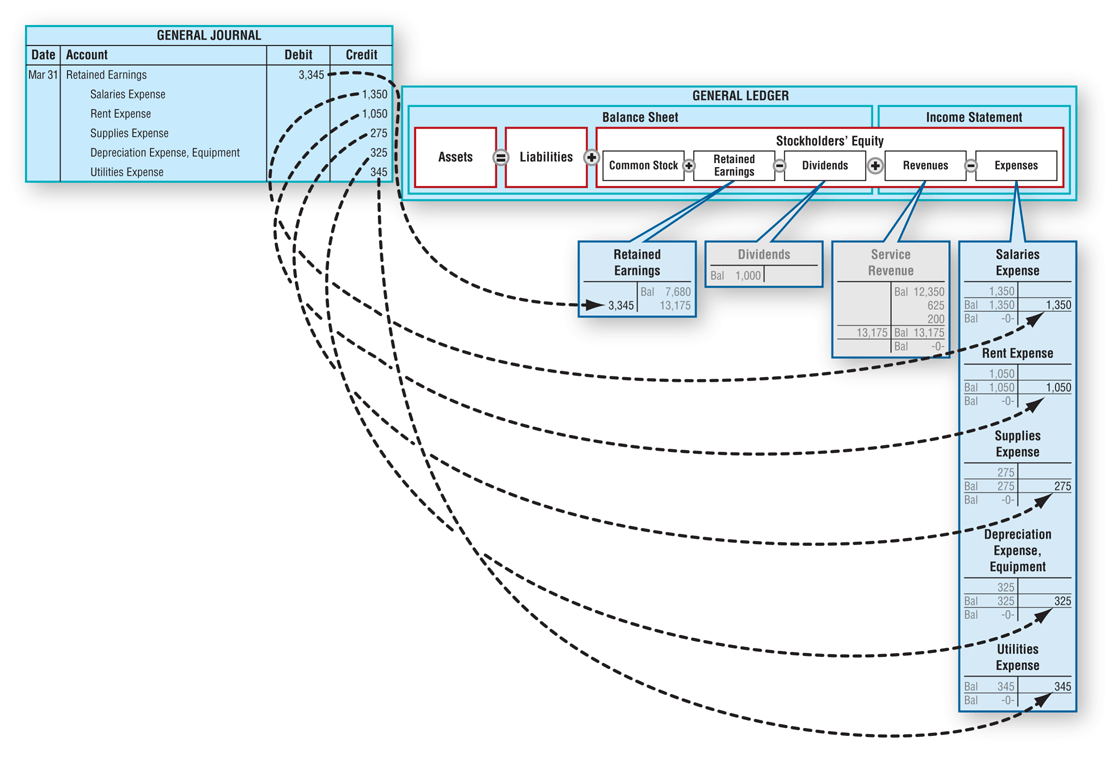

- Notice that the balance of the Income Summary account is actually the net income for the period.

- The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance.

- In other words, the closing entry is a method of making repayments on all the costs incurred within a given financial year.

- The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

- You should recall from your previous materialthat retained earnings are the earnings retained by the companyover time—not cash flow but earnings.

Therefore, we can calculate either profit margin for this company or how much it lost over the year. Notice that revenues, expenses, dividends, and income irs says business meals are tax deductible summaryall have zero balances. The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle.

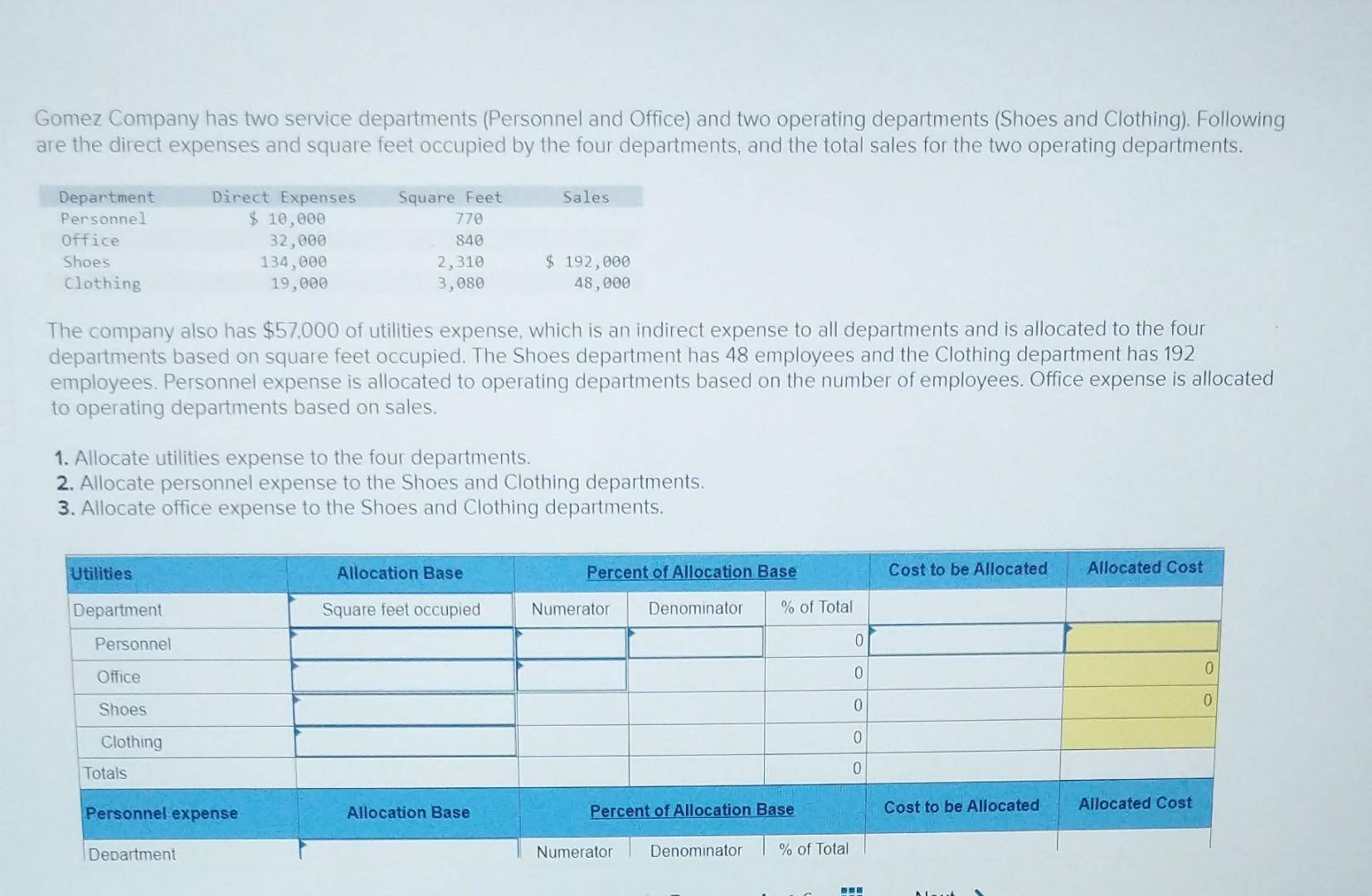

These accounts must be closed at the end of the accounting year. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends. Creating closing entries is one of the last steps of the accounting cycle.

Once you have completed and posted all closing entries, the final step is to print a post-closing trial balance, and review it to ensure that all entries were made correctly. Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). The eighth step in the accounting cycle is preparing closingentries, which includes journalizing and posting the entries to theledger. The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019. What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year?

Take note that closing entries are prepared only for temporary accounts. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations). No, permanent accounts carry their balances forward to the next accounting period. Revenue, expense, and dividends or withdrawals accounts are closed at the end of an accounting period.

Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. Temporary account balances can be shifted directly to the retained earnings account or an intermediate account known as the income summary account. Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted).

The secondentry closes expense accounts to the Income Summary account. Having a zero balance in theseaccounts is important so a company can compare performance acrossperiods, particularly with income. The income summary account is a temporary account solely for posting entries during the closing process. It is a holding account for revenues and expenses before they are transferred to the retained earnings account. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses.